It does not matter what part of Florida you live in. You are at risk for hurricane or tropical storm damage to your home. High winds and rain can cause devastating damage to the exterior and interior of your home. Storm damage can be significant, even if it is just a tropical storm.

Knowing what to do after a hurricane is just as important as what you do to prepare your home before the storm. All the steps you take before and after the event can have a significant impact on your hurricane damage claim.

Preparing For Home Hurricane Damage

Florida homeowners are encouraged to take every precaution before a storm arrives to protect their property. You should board up windows, put out sandbags around entranceways, and take other measures to secure your property. Additionally, you should make a video of the interior and exterior of your property before the storm and make sure that you know where your insurance papers are before the storm strikes.

Start your video with something that can officially document the date of the video. Then carefully walk around the exterior of your home, showing that there is no damage to your roof or other exterior areas. If you have already made storm preps like boarding up windows, make sure to show that in your video. Move to the interior and show everything, including your ceilings, to show that they are in good repair before the storm.

What Should You Do After A Hurricane?

There are three steps you should take to record the damage after a hurricane.

1. Make another video.

This time you are going to go through and record the exterior and interior of your home just like you did prior to the storm so that you can show the differences in the videos and the damage that occurred. You will also want to list personal items that may have been damaged as part of the storm. All of this information will be important for your hurricane damage insurance claim.

2. Take action to protect your home from further damage.

One of the main things that insurance adjusters like to use to reduce or deny hurricane damage claims is to say that the damage occurred after the storm. They will say that damage occurred in the storms that followed the hurricane or from not protecting your home.

Tarp your roofs and cover any damaged exterior areas with tarps or plywood. If you have excessive water inside your home, document the damage and your efforts to remove the standing water. Keep track of everything you do to protect your home from further damage – this is crucial information for your claim.

3. File an insurance claim as soon as possible.

The devastation of the storm may make you feel overwhelmed, but it is crucial that you file a hurricane damage claim as soon as possible after the storm.

When major storms hit a large area, it is not unusual for insurance companies to pay claims on a first-come-first-served basis. When you file a claim early, you stand a better chance of getting paid the full value of your claim.

Insurance companies have 14 days to respond to your initial claim for damage and then have 90 days to pay the claim in full. Of course, there are always exceptions, but this is the standard that they must follow to pay claims.

Florida Hurricane Lawyers at Landau Law

If you are having problems with an insurance company covering your hurricane home damage claim, speak with a hurricane claims attorney at Landau Law today. We offer free case consultations. Your attorney will help you get through the claims process and will ensure that the insurance company treats you fairly during this most trying time. Contact us today!

Hurricane Damage Blog Posts

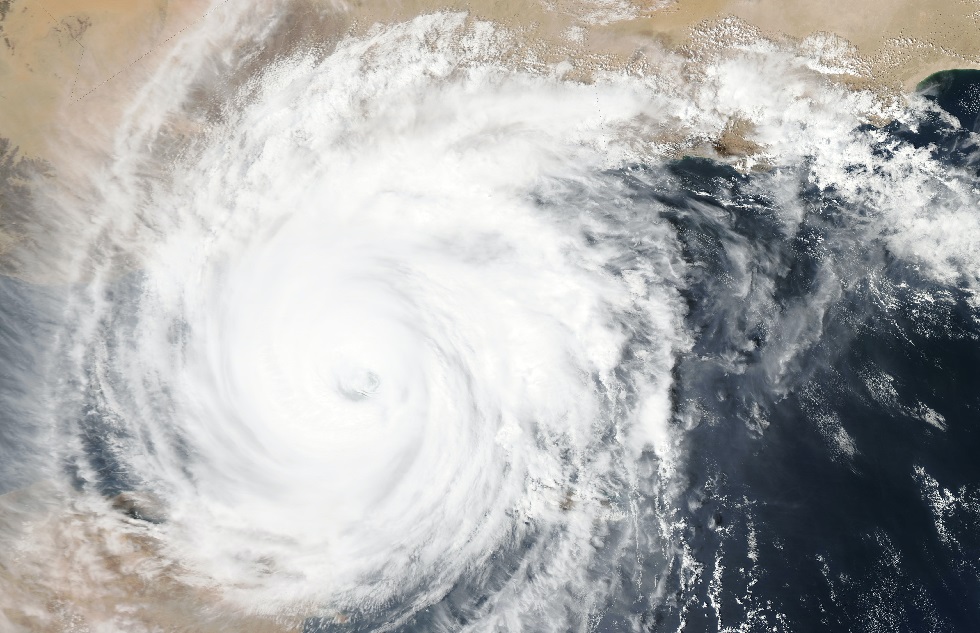

Why Does Florida Have So Many Hurricanes?

Florida is renowned for its beautiful beaches, vibrant culture, and, unfortunately, its frequent encounters with hurricanes. The state's unique geographical location and climate conditions make it particularly vulnerable to these powerful storms. Florida's position on...

What To Do If You’re Denied Hurricane Damage Claim For Home

Hurricane damage can be devastating for Florida homeowners, leaving them in a state of distress and financial uncertainty. When insurance claims for such damage are denied, it adds another layer of stress to an already difficult situation. Facing a denied claim...

Common Reasons Your Florida Hurricane Damage Insurance Claim May Be Denied

Florida homeowners face a daunting challenge when their hurricane damage insurance claims are denied. Understanding the common reasons for these denials can help you navigate the claims process more effectively. Insurance companies may deny claims due to inadequate...

Before and After a Storm Hits: What You Need To Know

Property Insurance laws have changed and so has the language in most policies. Make sure you’re prepared before the next storm hits. Understanding how the law changes will impact you and knowing what your policy actually covers (and doesn’t) is critical. That’s why...

What Does Hurricane Insurance Cover in Florida?

As Floridians, we understand the unique challenges that come with living in a hurricane-prone area. Hurricane insurance in Florida typically covers damage to our homes and personal property caused by hurricanes, including wind damage and, in some cases, flooding. It's...

How Long Does an Insurance Company Have to Settle a Hurricane Claim in Florida?

When it comes to hurricane damage in Florida, insurance claims are a common occurrence. However, many people are left wondering how long it takes for an insurance company to settle a hurricane claim. The answer to this question is not always straightforward, as it can...

How to File a Hurricane Insurance Claim in Florida

Filing an insurance claim after a hurricane can be a daunting task, especially if you're a Florida resident. With the increasing frequency of hurricanes in Florida, homeowners need to know how to file a hurricane insurance claim effectively. In this blog post, we will...

Renters Insurance For Florida Hurricane Coverage

Learn about the ways that renters insurance can help protect you after hurricane damage Renters insurance is a type of insurance policy that covers the personal property and liability of a renter. It can provide peace of mind in the event of a disaster, such as a...